(Updated for 2026)

Insurance Marketing has transformed rapidly over the past few years. In 2026, digital-first communication, AI-driven comparison tools, and localized intent-based searches will shape how potential clients look for agents and coverage options. These changes are indicative of those currently affecting the commercial search industry on a wider scale. Strategic SEO is a way to not only remain relevant in such a fluid industry, but to dominate instead.

In this guide, we’ll walk you through the five most effective SEO strategies insurance agencies should use to succeed with SEO in 2026.

1. Consistent, Informative Content that Aligns with Your Brand

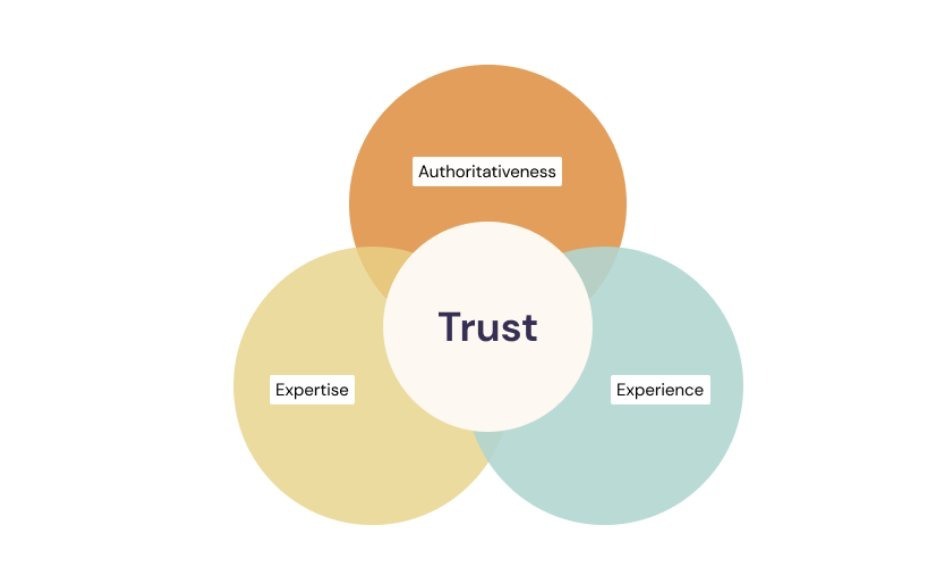

One of the foundational elements of SEO for insurance is having helpful, relevant, and original content that supports your brand identity. In 2026, this means going beyond basic blog posts about “What is term life insurance?” Your content should reflect first-hand experiences, client education, and your unique perspective, aligned with Google’s updated E-E-A-T guidelines (Experience, Expertise, Authoritativeness, Trustworthiness).

Figure 1.1 shows how the various components of E-E-A-T combine to create a fundamentally sound piece of content. Authoritativeness, Experience, and Expertise build off of one another to create trustworthy sites and content, ones that Google believes should be pushed to the top of the rankings.

Here’s what that looks like:

- Consistently publishing blog posts, guides, service pages, and FAQs written with your target audience (and keyword strategy) in mind.

- Using real-world examples, case studies, or team insights that present actual experience, not generic rewrites.

- Leveraging AI-generated content wisely: combine AI with human insight, rather than relying on it to write entire pages. (Google’s Helpful Content Update evaluates usefulness, not author.)

Pro Tip: Use keyword clusters based on “people also ask” queries and local search intent to inform your topic selection. In the current search climate, helpful and niche-targeted content performs better than broad, generalized pieces.

2. Create Accurate Citations on Varying Scales

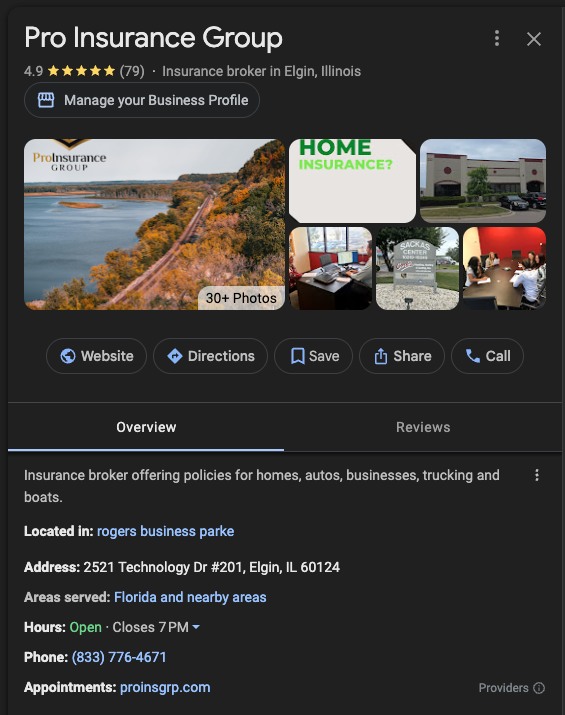

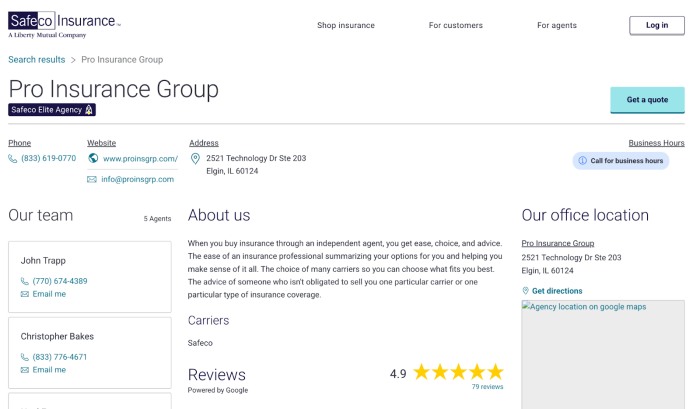

While content powers your on-page SEO, citations help amplify and verify your presence off-page. Citations, mentions of your name, address, and phone number (NAP), are incredibly important in local SEO for insurance agents.

Figure 2.1 Shows Pro Insurance Group’s local Google Business Profile, allowing consumers to easily find not only their NAP, but also maps, service offerings, as well as recent posts and updates. Figure 2.2 Shows Pro Insurance Group listed in a national directory, advertising their NAP, top agents, reviews, and more. Both of these platforms are citations that reinforce the Brand Authority of the firm, allowing consumers, search engines, and LLMs (Large Language Models) to easily find and verify the businesses’ information.

2026 citation strategy best practices:

- Maintain consistency across high-authority local directories like Google Business Profile, Bing Places, and Yahoo Local.

- Utilize national platforms like insurance directories (e.g., Agent Review websites), press releases, academic research citations, and government listings.

- Use citation monitoring tools to check for duplicate or inconsistent entries and correct them promptly.

Google’s local ranking factors now look at NAP alignment, your review signals, content freshness, and even image metadata. Optimizing your citations across a broader scale builds trust, both with Google and your prospective clients.

Step 3: Understanding How People are Searching for Your Brand

Google Search is no longer as dominant as it once was in the commercial search industry.

With the advancement of generative search experiences and voice assistants such as: Perplexity, ChatGPT, SGE (Search Generative Experience), and Alexa, your agency’s online visibility must extend beyond traditional search engines.

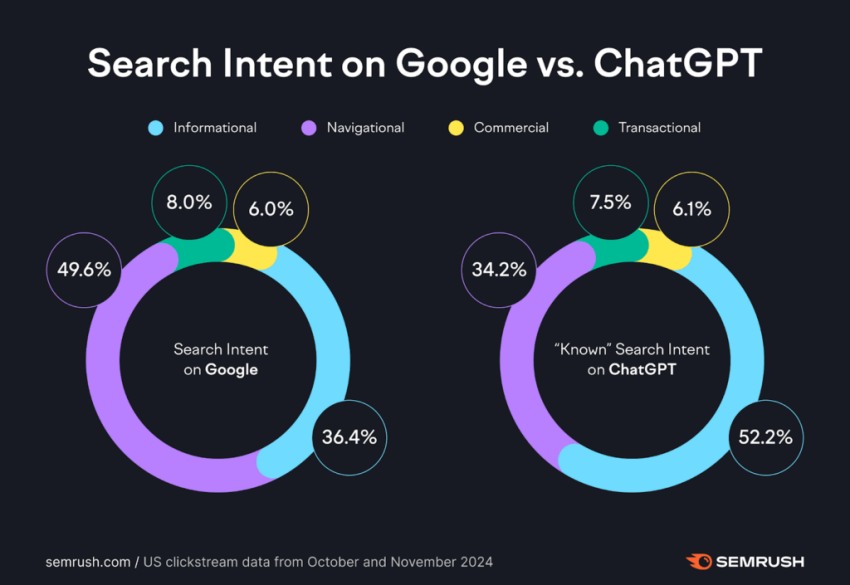

Figure 3.1 contains a chart created by Semrush, that shows the search intent of users between Google and ChatGPT. When it comes to navigation, Google still reigns supreme, however ChatGPT has recently become widely-adopted as the new method of informational search across the web.

What this means in 2026:

- Users may ask digital assistants: “What’s the best insurance agency near me that handles high-risk auto policies?” If your content is optimized with structured data and natural language, you’re more likely to be found.

- Optimize for zero-click search by ensuring your business appears in Google Knowledge Panels, AI-generated answers, and “choose-your-own-adventure” chat results from search engines.

- Monitor branded vs. non-branded search patterns: Consumers increasingly favor brands that demonstrate transparency and availability across multiple touchpoints, including social media, review platforms, and third-party content.

Pro Tip: Semantic search, intent optimization, and AI-friendly content formatting aren’t buzzwords anymore, they’re key components of how you get found online.

Step 4: Understanding How Google Sees Your Brand

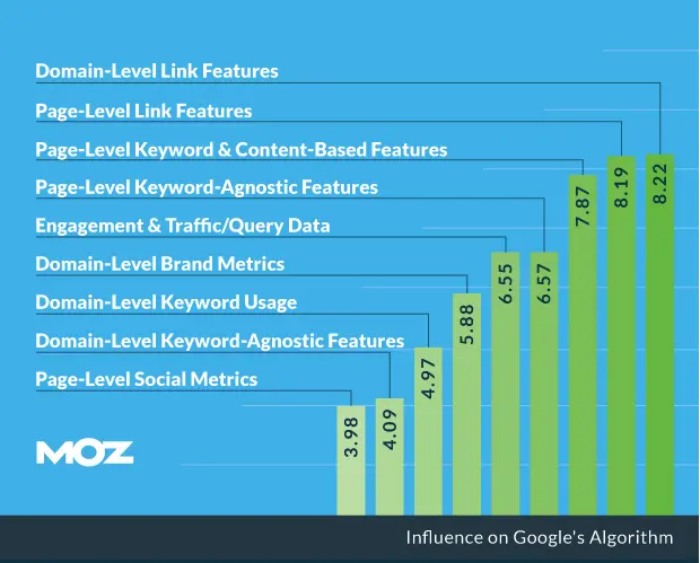

Let’s talk ranking, and what matters in Google’s current SEO algorithm.

In 2026, search engines’ evaluation criteria has moved even further toward context-based relevance and trustworthiness over raw keyword repetition. Google now uses 5 primary ranking criteria: Meaning, Relevance, Quality, Usability, and Context. These criteria prioritize Brand Authority, rather than popularity or frequency.

Key updates to keep in mind:

- The Helpful Content Update penalizes sites written for search engines rather than people. Your pages should deliver clear, useful answers with supporting imagery, data, or transactional intent.

- Sitewide E-E-A-T signals (about pages, author bylines, reviews, certifications) now influence whether or not your content is trusted, especially in finance and insurance.

- Google’s AI models now evaluate site authority using a range of on- and off-page signals, including traffic engagement time, bounce rates, and navigation quality.

Figure 4.1 Shows a figure created by Moz, detailing the importance of various features and data, and how Google views those factors. Google prioritizes sites with both domain and page level links, as these links are indications that your brand is reputable and other companies are comfortable citing your content and having your domain mentioned on their own site.

What this means: Google doesn’t just “see your site”, it understands your brand. Optimizing titles, descriptions, schema, and review profiles helps Google connect the dots between your name, services, and location-based intent. That’s key to climbing competitive rankings in the saturated insurance marketplace.

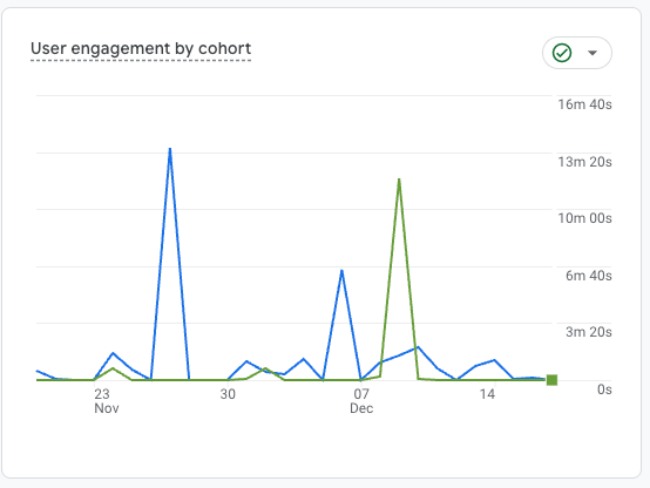

Step 5: Use Re-marketing to Stay Relevant in the Client’s Mind

It’s long been true in marketing: It’s cheaper to re-engage someone who knows you than to convert someone who doesn’t.

Figure 5.1 Shows how re-marketing can be a useful tactic for insurance agencies. With data taken from Atlas Insurance, it can be seen that initial customers (Blue Line) will often return around a week later (Green Line) and retain most of their engagement on-site. These are users already aware of the brand, who on their own, are returning to the site to seek more information. Re-marketing seeks to capture these users, offering new or updated policies, at a fraction of the cost of engaging new users who are unaware of the brand.

That’s why re-marketing remains an essential tactic for insurance SEO in 2026, and the platforms have only gotten smarter.

Here’s how re-marketing helps:

- You can serve highly personalized ads (based on services viewed or blog posts read) to site visitors once they leave your page.

- These re-marketing ads keep your brand front-of-mind when users compare multiple insurance options.

- You boost conversions by appearing where people already spend time: LinkedIn, Facebook, Google Display Network, YouTube Shorts, and programmatic ad platforms.

Your objective here isn’t just repetition, it’s relevance. The more precisely you shape your re-marketing messages to the client’s interests, the more cost-effective and conversion-focused they become.

Final Thoughts: Building a Strong SEO Foundation for Your Insurance Agency

We’re in a new era where search intent, technical SEO, semantic context, remarketing, and brand expertise all converge. Insurance agents that treat SEO not just as a checklist, but as a customer acquisition and retention strategy, will continue to thrive in 2026 and beyond.

Let’s wrap up the key takeaways:

- SEO for insurance must lean into E-E-A-T, high-quality content, and clear demonstrations of relevance and trust.

- Local and national citations build visibility, but consistency is non-negotiable.

- How users search has changed: optimize for conversational queries and AI-powered search tools.

- Structured, helpful content helps Google “see” your site as authoritative.

- Remarketing makes the most of your existing site traffic and improves ROI.

At 321 Web Marketing, we help insurance agencies of all sizes modernize their digital strategy so they’re not only ranking, but converting.

Before beginning any work, we run a comprehensive audit of your insurance website, and show you how search marketing can fuel your growth into 2026. Contact us today to schedule a free insurance marketing consultation.