Advertising your insurance products can often seem like a huge chore, especially for individual brokers or smaller insurance companies who may already feel overwhelmed by the day to day tasks of running a business. Furthermore, with the lack of clear data from traditional advertising methods, it can be hard to know if your marketing efforts are even working. While relying on traditional insurance digital marketing services such as newspaper ads, banners, direct mail, or the occasional tv-ad can seem like a great investment, it can be hard to know how many people are seeing those ads, let alone using them. An insurance digital marketing campaign, in contrast, can take much of the uncertainty out of the equation.

Advertising your insurance products can often seem like a huge chore, especially for individual brokers or smaller insurance companies who may already feel overwhelmed by the day to day tasks of running a business. Furthermore, with the lack of clear data from traditional advertising methods, it can be hard to know if your marketing efforts are even working. While relying on traditional insurance digital marketing services such as newspaper ads, banners, direct mail, or the occasional tv-ad can seem like a great investment, it can be hard to know how many people are seeing those ads, let alone using them. An insurance digital marketing campaign, in contrast, can take much of the uncertainty out of the equation.

The insurance marketing campaign can provide you with up to the minute data on how many people are on your website, reading your content, or engaging with you through social media.

Top Benefits Of Insurance Digital Marketing Campaigns

Effective insurance digital marketing campaign can lead to increased brand visibility and loyalty, qualified leads, and revenue, all with a greater return of investment (ROI) than traditional advertising methods. Read more about the many benefits insurance marketing can provide to agencies that are seeking to spread the word about their business and services through digital marketing services.

Increased Online Visibility Through Content Generation

The vast majority of people seeking services such as insurance do research online before deciding who to contact. Thus, if a potential client starts online, and your website and web content rank well for search terms that meet the criteria of their search query, your business will be among the first insurance companies they will likely click on. This significantly increases the chances they will do business with you, or at very least visit your site. This is the foundation of search engine optimization (SEO), the process of increasing the online visibility of a website or a web page in a search engine’s unpaid search results page.

Figure 1.1 shows monthly clicks & impressions for one of our insurance clients during the first month of their insurance marketing campaign. Figure 1.2 shows monthly clicks & impressions during month 5 of their campaign.

By consistently creating search-optimized content that your customers can find useful and applicable for their insurance needs, such as blog posts about your policies, your website and brand will capture more search queries of people looking for similar content. This will result in more potential clients viewing your website and content (brand exposure), directly leading to more qualified leads and conversions.

Building A Cohesive Brand Across Multiple Channels

Brand recognition is a marketing concept used to describe the ability of consumers to correctly recall a brand when asked. You likely have no problem recalling that Pepsi is a popular soda manufacturer, or that Apple makes Mac computers and iPhones. But how many average consumers do you think can recall your insurance company, when prompted? Building an online presence through insurance marketing puts your company directly in front of potential customers and future customers alike. This can boost your brand recognition and loyalty, enabling more customers to readily think of your business when they find themselves in need of insurance services.

Social media marketing can be an especially effective tool in this process. Social media can allow your agency to be more accessible to potential customers, as well as make your brand more connected with existing ones. They may discover or be reminded of your company after seeing an ad in their newsfeed, or after consecutively browsing your business page while looking for industry-relevant content. This can position your brand at the forefront of consumers’ minds when they begin to consider purchasing insurance policies or looking for professional brokers.

Boosting Customer Acquisition Through Social Media Marketing

Creating an online community by directly engaging with customers through your social media pages can also build brand loyalty. Insurance has increasingly become an impersonal and complex process, causing many people to turn to the internet to make sense of it. Thus, by responding to customer questions or offering advice online, you can humanize your brand and distinguish it as one that genuinely cares its customers. This can heavily distinguish your brand from the vast majority of insurance brokers who do not invest as many resources into improving their customer service; likewise, it can dramatically increase a potential client’s willingness to do business with your agency knowing they have access to policy support. As your brand becomes more appealing to customers than their alternatives, more and more viewers will consider your company first.

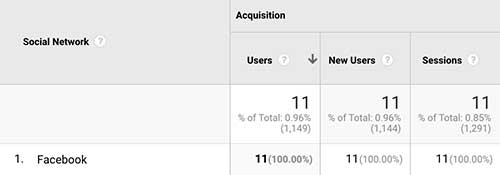

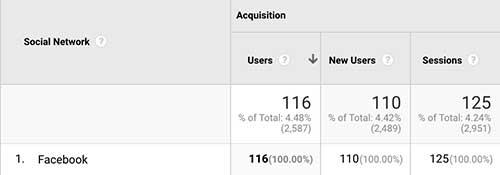

In Figure 1.3, you can see our clients number of monthly website users which came from Facebook, prior to their social media marketing campaign. Figure 1.4 shows the increase in website visitors from Facebook, just one month after starting their social media marketing campaign.

Turning Qualified Leads Into Sales

Not only can digital marketing create widespread awareness of your brand; it can also make it much more likely that your firm’s services will reach the right audience. With social media and email marketing, your audience can quickly expand when current subscribers share or forward your posts or email newsletters to friends and family who may find your content relevant or interesting. These additional views represent a potential increase in qualified leads and potential sales, with zero marginal cost. This can quickly and efficiently transform leads into sales and referrals into loyal customers, effectively scaling your business with minimal effort.

Not only can digital marketing create widespread awareness of your brand; it can also make it much more likely that your firm’s services will reach the right audience. With social media and email marketing, your audience can quickly expand when current subscribers share or forward your posts or email newsletters to friends and family who may find your content relevant or interesting. These additional views represent a potential increase in qualified leads and potential sales, with zero marginal cost. This can quickly and efficiently transform leads into sales and referrals into loyal customers, effectively scaling your business with minimal effort.

Using Market Data For More Specific Customer Segmentation

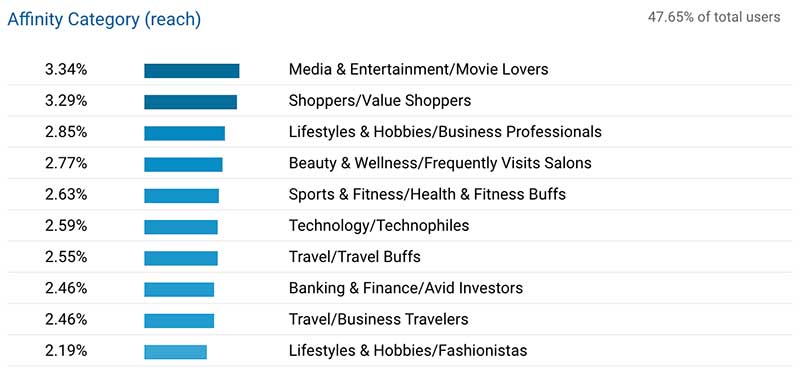

Based on marketing-driven campaign data, your customer base and target audience can be further segmented into more specific categories based on their interactions on social media sites and elsewhere. This can allow you to create website content that is tailored to align with their unique goals or needs, as well as create advertising campaigns that target specific groups of people in need of particular services.

For example, you might create a social media advertising campaign for college students likely in need of renters insurance, and create supplemental content to coincide with the campaign. Or, you might target families with sixteen-year-olds who need auto insurance. Various tools can analyze multiple factors, such as geographic location, demographics, interests, and more, to help determine which people are most likely to respond to different types of content. This can help you put the most effective advertisement in front of the most relevant audience, potentially leading to a significant boost in qualified leads and sales.

Figure 1.5 shows data from Google Analytics segmenting website users interests that can be used to target specific audiences with content or emails to improve customer acquisition.

Using Market Data & Segmentation To Optimize Customer Retention

With the help of email and social media marketing, your company can receive a multitude of data, such as how often people are opening your emails or what content gets most viewed on your site. This data can then be used to develop more effective advertising campaigns in the future. For example, after seeing how a particular campaign plays out over the course of a month, you may choose to redesign your email newsletters or target keywords that are more likely to generate traffic.

This process of consistently optimizing your content based on consumer insights, market data, and SEO-best practices can further expand the scope and quality of your content. This will allow you to maintain the trust (and brand recognition) of your audience over time by establishing your brand as an industry leader. Thus, when customers’ plans renew and it is time for them to consider whether to choose a new provider, you can feel confident knowing your current customers have sufficient reasons to stay on board with your agency.

Hiring An Experienced Insurance Digital Marketing Agency

Marketing your insurance services may seem like a daunting task, but an insurance marketing agency can provide you with effective, professional digital marketing services that make the entire process much easier. 321 Web Marketing uses a variety of digital marketing methods, such as content generation, effective SEO techniques, custom website development, and keyword research to ensure that your insurance agency will reach more qualified leads in minimal time. Contact 321 Web Marketing today to get started on your custom insurance marketing campaign.

"*" indicates required fields

Related Articles:

- Insurance Marketing Case Study

- Successful Insurance Marketing Campaigns

- Ultimate Insurance Marketing Guide

- Benefits Of Working With Insurance Marketing Agencies

Updated: February 19th 2020